Make a Legacy Gift

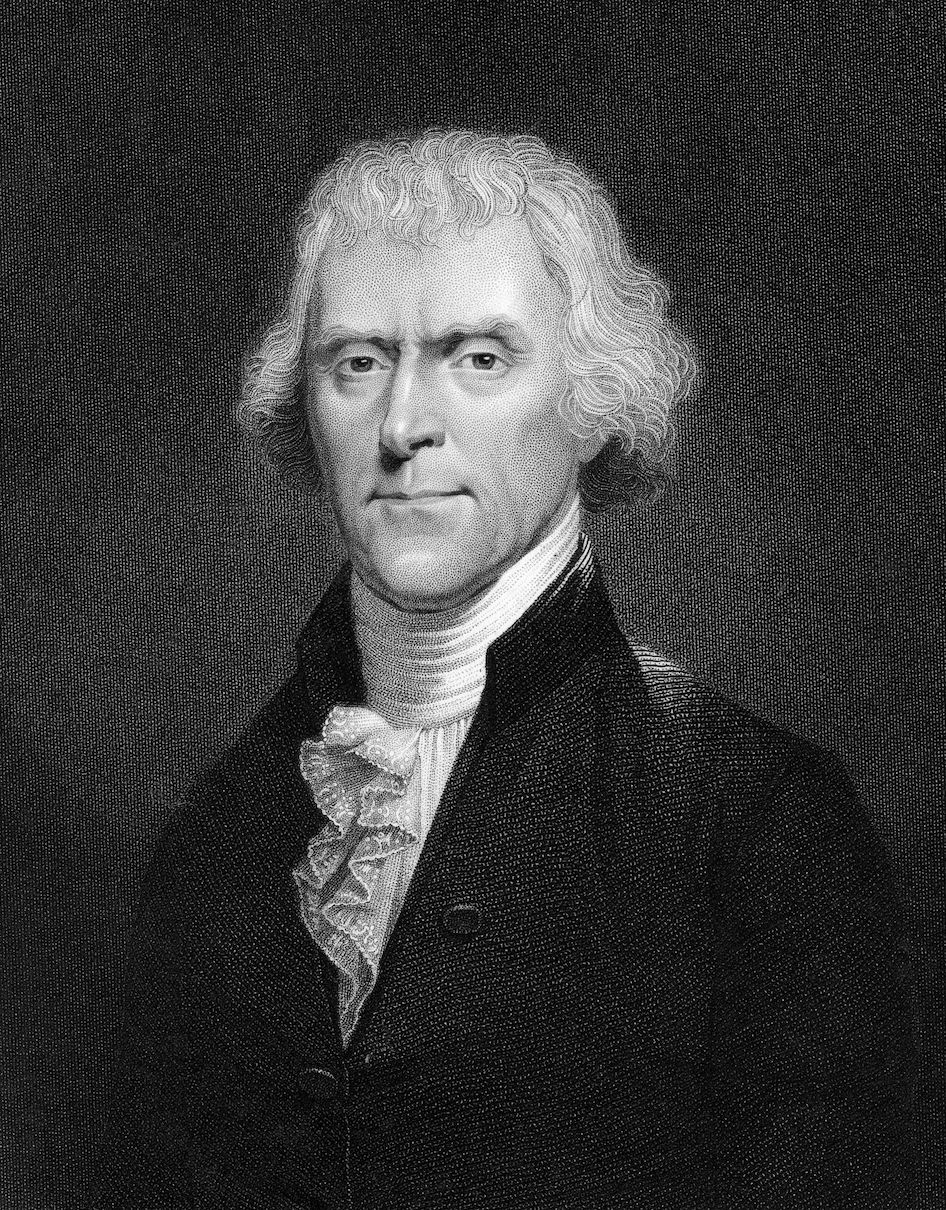

ACTA’s Thomas Jefferson Legacy Society

“I deem it the duty of every man to devote a certain portion of his income for charitable purposes; and that it is his further duty to see it so applied and to do the most good for which it is capable.” —Thomas Jefferson

Thomas Jefferson, founder of the University of Virginia, was an ardent guardian of freedom of speech and religion, and he recognized that all citizens need access to education to reach their full potential. These are the principles that inform ACTA’s mission.

As you consider your legacy, please remember Thomas Jefferson’s vision and know that ACTA is fighting to keep the flame of liberal learning alive.

How can I plan now to preserve the foundational principles of higher education?

By making a legacy gift—remembering ACTA in your estate—you will help carry the torch for academic excellence, academic freedom, and accountability at America’s colleges and universities.

Gifts through your estate plan are a simple yet profound way to preserve your legacy by ensuring the future of ACTA’s work.

Establish your Legacy Today

Support ACTA through the vehicle that best fits your plans, and please tell us about your gift so we can honor you as part of our Thomas Jefferson Legacy Society.

A simple bequest through your will

Use language such as, “I give, devise, and bequeath to the American Council of Trustees and Alumni (52-1870003), located in Washington, DC, [dollar amount, percentage of estate, or property] to be used for its general support (or for the support of a specific program).”

Life insurance and investment products

Make ACTA a designated beneficiary of your life insurance plan, bank, or investment account. This simple step—usually involving one form—is flexible if your family needs change, reduces your family’s tax burden, and will carry forward ACTA’s mission far into the future.

Retirement plan assets—like an IRA—that designate ACTA as a primary or contingent beneficiary

IRAs, 401ks, and other qualified retirement plans can be leveraged now to benefit you and your family, whilst supporting ACTA’s mission and reducing the burden of federal taxes.

- Designate ACTA as a beneficiary.

- Take advantage of an IRA Charitable Rollover.

- If you are 70 ½ or older, make a Qualified Charitable Distribution through your Traditional IRA.

Many IRA and 401k options offer significant tax benefits to you—even if you take the standard deduction—and/or your loved ones. Talk to your plan administrator today!

Legacy gifts to ACTA offer different tax planning advantages, so please consult with your financial advisor or estate planning professional.

If you have any further questions, or to let us know you’ve remembered ACTA in your planned giving, please contact Emily Koons Jae by phone at (202) 798-5451 or by email at ejae@goacta.org.

ACTA is a nonprofit, educational, tax-exempt organization within the meaning of Section 501(c)(3) of the Internal Revenue Code. Contributions to ACTA are deductible to the fullest extent provided by law. ACTA’s Federal Identification Number is 52-1870003.

WHO WE ARE

Launched in 1995, we are the only organization that works with alumni, donors, trustees, and education leaders across the United States to support liberal arts education, uphold high academic standards, safeguard the free exchange of ideas on campus, and ensure that the next generation receives an intellectually rich, high-quality college education at an affordable price.

Discover MoreSTAY INFORMED

Sign up to receive updates on the most pressing issues facing our college campuses.